The U.S. Gaming Market: An Overview

- Holding the second largest gaming market globally, the U.S. is expected to reach approximately USD 90.79 billion (approx. KRW 126.107 trillion) by 2029

- According to KOCCA’s Gaming White Papers, the U.S. market size has slightly increased, from 22% in 2022 to 22.8% in 2023.

- As per the analysis by Sensor Tower, the U.S. mobile gaming market is deemed to be the most profitable in the world, reaching USD 23.3 billion (approx. KRW 32.367 trillion) in 2023. The market is expected to continue to grow from 2024 to 2028, reaching USD 33.5 billion (approx. KRW 46.315 trillion) by 2028.

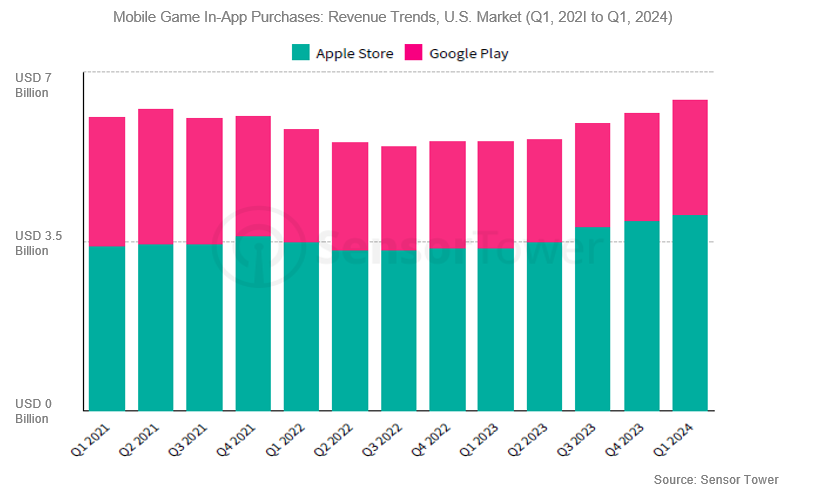

- Continuing their analysis, Sensor Tower noted the U.S. mobile gaming revenue fell in 2022 following the pandemic but has remained relatively stable since the first half of 2023; compared to the previous year, mobile gaming revenues was up 5.7% in Q3 for 2023, with an additional 3.8% in Q4.

- Among mobile games, in 2023, revenue from in-app purchases generated from casual games accounted for 60%, generating USD 13.9 billion (approx. KRW 19.071 trillion), its position indicating its importance in the market.

- The Gaming White Papers from the KOCCA has identified that in 2022, the number of U.S. gaming users reached 197.16 billion, accounting for 66% of the total population, with adults comprising of 65% of the total adult population and minors making up 71% of the total minor population.

The Current State of the U.S. Gaming Market

1. Mobile Games

- App stores, organic content marketing, paid advertising, and influencer marketing are some of the main sources of acquisition channels for mobile games in the U.S.

- Based on this information, Asia-Pacific publishers also value these game acquisition channels.

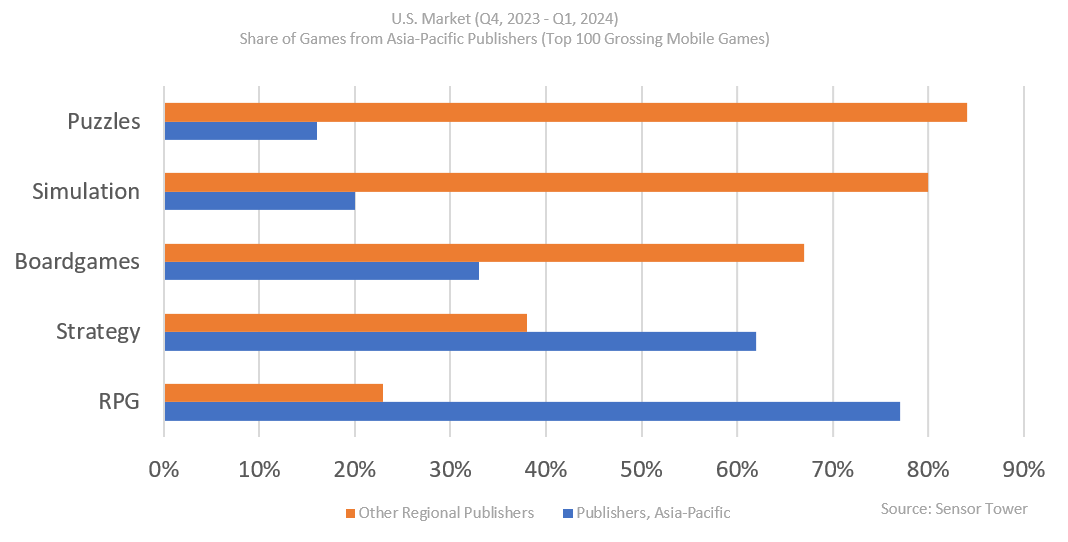

- With mobile RPGs and strategy games being the most popular genres, accounting for 77% and 62%, respectively, of the top 100 games in the US games market over the past six months, for Asia-Pacific publishers, the US game market is an important market.

- “The Last War: Survival,” a strategy mobile game, is a great example of such interest, as it has seen great success in the U.S. market, with downloads and revenue growing at a brisk pace since November 2023.

- From November 2023 to February 2024, the monthly revenue for the strategy game, “Last War: Survival” grew by 188%, 390%, 170%, and 67%, respectively, in consecutive months, with a cumulative global revenue reaching USD 180 million by February 2024.

2. Console Games

- From the Issue Briefing by Incross, in 2022, the global console market was anticipated to generate USD 58.6 billion (approx. KRW 81.394 trillion) in revenue. Of that revenue, the U.S. console gaming market made up USD 7.25 billion (approx. KRW 10.702 trillion), or 12.3% of the total market.

- In the U.S., console game usage is second only to mobile games at 33%, with 55% being male players, outnumbering the pace of female players.

- Based on a survey of players, in December 2022, the most popular devices among them were Nintendo Switch (126.9 million units), followed by PlayStation 5 (124.53 million units) and Xbox XIS (84.46 million units).

- Additionally, the top-grossing games per console platform were: Nintendo Switch (Pokemon: Scarlet/Violet), PlayStation 5 (Call of Duty: Modern Warfare 2), and Xbox (Call of Duty: Modern Warfare 2) .

U.S. Gaming Industry: Outlook

- Unlike the gaming market in general, which is characterized by hyper-casual genres and lean towards more female players, the U.S. mobile gaming market identifies casino games as being the popular game of choice.

- KOCCA’s U.S. Content Industry Trends cites that whilst the U.S. gaming market may differ from the Korean gaming market, there are opportunities to enter the U.S. market, with such games as Go-Stop, a popular game in the Korean market.

- App Annie’s research notes, among the top game publishers worldwide, top-ranked Korean companies such as Netmarble (5), NCSoft (18), Com2us (31), Pearl Abyss (44), Kakao Games (45), and DoubleU Games (46), have all gained traction in the U.S. through their comprehensive use of localization.

- In particular, when DoubleU Games launched its casino game in the U.S., they were sure to localize its content.

- Through such actions as localization strategies and development of locally customized game content, Korean games have entered the U.S., expanding their reach